Participating in the 401(k) Retirement Plan is one of the best things you can do to save for your future.

Why you should join

- Free money from Intuit through eligible matching contributions—$1.25 for every $1 you contribute, up to 6% of your eligible annual pay for a maximum $10,000 per year

- A clear view of how much you will need in retirement, in the context of monthly income

- Flexible saving opportunities through pretax, Roth, or after-tax contributions from your base salary and/or bonus; also, in-plan Roth conversion for even more expanded options

- Access to experienced retirement services professionals—via phone, email, or chat—to help get you on the right track to reach your retirement goals

Eligibility

Regular full-time and part-time, SelectTime, and Seasonal employees. If you’re a SelectTime or Seasonal employee, visit the benefits site for you.

Eligibility for Intuit matching contributions: If you make pretax elective contributions (or they are made for you through automatic enrollment), or you make Roth elective contributions, you are automatically eligible to receive Intuit matching contributions based on Intuit’s matching contribution formula in effect at the time. Matching contributions will not be made on regular after-tax (non-Roth) contributions or catch-up contributions.

How it works

How to enroll

Learn how to enroll in the 401(k) plan.

How to save

You have three ways to contribute to the 401(k) plan—pretax, Roth and after-tax:

Pretax contributions

| Contributions | Deducted from your paycheck before taxes are withheld, reducing current taxable income |

| Limits* | Up to 50% of your eligible compensation, subject to the IRS limit ($23,000 in 2024). If you are age 50 or older in 2024, you can contribute an additional $7,500 |

| Withdrawals | Subject to income tax |

Roth contributions

| Contributions | Deducted from your paycheck after taxes are withheld |

| Limits* | Up to 50% of your eligible compensation, subject to the IRS limit ($23,000 in 2024). If you are age 50 or older in 2024, you can contribute an additional $7,500 |

| Withdrawals | Tax-free† |

After-tax contributions

| Contributions | Deducted from your paycheck after taxes are withheld |

| Limits* | Up to 50% of your eligible compensation, or the plan limit ($36,000 in 2024) |

| Withdrawals | Contributions are tax-free, earnings are subject to income tax |

* Contribution limits refer to the combined total of traditional and Roth contributions. The after-tax limit is inclusive of the combined total of traditional, Roth, and employer-matching contributions.

† Earnings are tax-free upon withdrawal if you own the Roth 401(k) account for at least five years and have reached age 59½.

Matching contributions

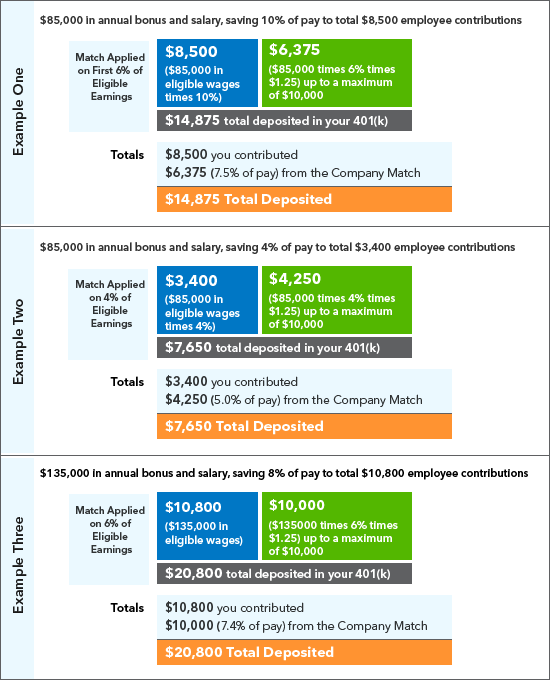

For each $1 you contribute to your 401(k) account, Intuit will contribute $1.25, up to 6% of your eligible annual pay to a maximum of $10,000 per year. If you’re not already saving 6%, you’re missing out on a valuable part of how Intuit helps you build financial security.

Here's an example of how it works.

Green: Intuit’s contribution

Blue: your contribution

Orange: the total contribution toward your retirement

Note: If you change your savings percentage during the year, your year-to-date contributions and pay will be used to determine your match. Also, matching contributions will not be made on regular after-tax contributions or catch-up contributions.

Roth in-plan conversions

In-plan Roth conversions give employees the opportunity to convert pretax and/or after-tax (non-Roth) deferrals to Roth money within the Intuit 401(k) plan. Taxes may be owed upon conversion, but future qualified distributions will be tax-free. Only vested money is eligible to be converted.

Call Empower Retirement at 844-INTU401 (844-468-8401) for more information and instructions.

How matching contributions are vested

Vesting is a term used to describe how much of Intuit’s matching contributions you “own.” It’s the percentage of the match that you could take with you when you change jobs or retire, and it depends on your years of service. You always own 100% of your own contributions. Matching contributions are 100% vested immediately.

Common questions

- How to select your investment options

- How to roll-in a 401(k) or IRA

- How to take a loan

- How to add or change a beneficiary

Resources

- Empower website

- Visit the Events page to register for an upcoming financial planning webinar or view recordings of past events.

- 401(k) Summary Plan Description

Where to get help

Empower

844-468-8401

Visit website

My Benefits

800-381-8881

Visit website